All Categories

Featured

Table of Contents

- – Is there a way to automate Infinite Banking Re...

- – Can Infinite Banking Benefits protect me in an...

- – How does Infinite Banking Concept create fina...

- – How do I track my growth with Infinite Wealth...

- – How long does it take to see returns from Fi...

- – Is there a way to automate Infinite Wealth S...

- – How do I optimize my cash flow with Infinite...

The idea behind limitless banking is to use this cash money value as a source of funding for different functions, such as investments or personal expenses, while still gaining substance rate of interest on the cash worth. The idea of infinite banking was initial recommended and popularised by Nelson Nash, a financial advisor and author of guide "Becoming Your Own Lender".

The insurance holder borrows versus the cash value of the plan, and the insurance firm bills passion on the finance. The interest rate is typically lower than what a financial institution would charge. The policyholder can use the loaned funds for different objectives, such as spending in actual estate or beginning a company.

It is vital to keep in mind that the insurance policy holder needs to not only pay the home loan on the investment residential property however also the rate of interest on the plan lending. The interest settlements are made to the insurance agent, not to oneself, although the policyholder may receive rewards as a common insurance business's shareholder

This security can be interesting those who choose a traditional method to their financial investments. Unlimited banking supplies insurance policy holders with a resource of liquidity via policy lendings. This implies that even if you have borrowed versus the money worth of your plan, the cash money value continues to grow, supplying versatility and access to funds when needed.

Is there a way to automate Infinite Banking Retirement Strategy transactions?

The survivor benefit can be utilized to cover funeral prices, arrearages, and various other costs that the family may sustain. On top of that, the death benefit can be invested to provide lasting monetary safety and security for the insurance holder's household. While there are potential benefits to unlimited financial, it's important to consider the downsides too: One of the key objections of infinite banking is the high prices related to whole-life insurance coverage plans.

In addition, the fees and commissions can eat into the money value, minimizing the general returns. When utilizing unlimited banking, the policyholder's financial investment options are limited to the funds available within the plan. While this can offer security, it might additionally restrict the potential for greater returns that can be accomplished through various other investment lorries.

Can Infinite Banking Benefits protect me in an economic downturn?

Consider the case where you bought one such policy and conducted an in-depth analysis of its performance. After 15 years into the policy, you would have discovered that your policy would have been worth $42,000. Nevertheless, if you had actually merely conserved and spent that money instead, you could have had more than $200,000.

To totally evaluate the feasibility of limitless financial, it's important to understand the costs and costs related to entire life insurance policy policies. These charges can vary depending on the insurance provider and the certain policy. Wealth management with Infinite Banking. Costs expenditure fee: This is a portion of the premium amount that is subtracted as a fee

How does Infinite Banking Concept create financial independence?

Per device fee: This cost is based upon the survivor benefit amount and can vary depending on the policy. Expense of insurance policy: This is the price of the required life insurance policy coverage related to the plan. When calculating the prospective returns of a boundless financial technique, it's important to variable in these charges and charges to identify truth value of the cash worth growth.

These people typically intend to sell the idea and downplay fee effects. To avoid making errors and shedding money, it is suggested to keep your economic technique simple. If you call for life insurance, choose term insurance coverage, which provides protection for a particular period at a lower price. By doing so, you can assign the conserved premiums in the direction of financial investments that use greater returns and better flexibility.

Using a whole life insurance policy as a private banking system, Infinite Banking allows for complete liquidity. how to use infinite banking for investments.

With Infinite Banking, individuals can finance major purchases while maintaining complete financial autonomy.

Insurance brokers help clients customize an Infinite Banking strategy for long-term success. Get a free strategy session to discover how Infinite Banking can accelerate your wealth.

How do I track my growth with Infinite Wealth Strategy?

It's vital to discover various alternatives and seek advice from with a monetary consultant to identify which strategy lines up best with your monetary goals and take the chance of resistance. Now that you have an extensive understanding of limitless banking, it's time to evaluate whether it's the appropriate strategy for you.

At the exact same time, term life insurance policy does not supply any kind of cash worth, implying that you will certainly not receive anything if you outlast the plan. Furthermore, term life insurance coverage is not long-term, indicating that it will run out after a specific time period. Boundless financial can be a great idea for individuals that are looking for a long-term financial investment strategy and who are prepared to make substantial capital expense.

How long does it take to see returns from Financial Independence Through Infinite Banking?

This site supplies life insurance policy details and quotes. Each price revealed is a quote based on details given by the service provider. No section of may be duplicated, published or distributed in any type of manner for any type of purpose without previous written permission of the owner.

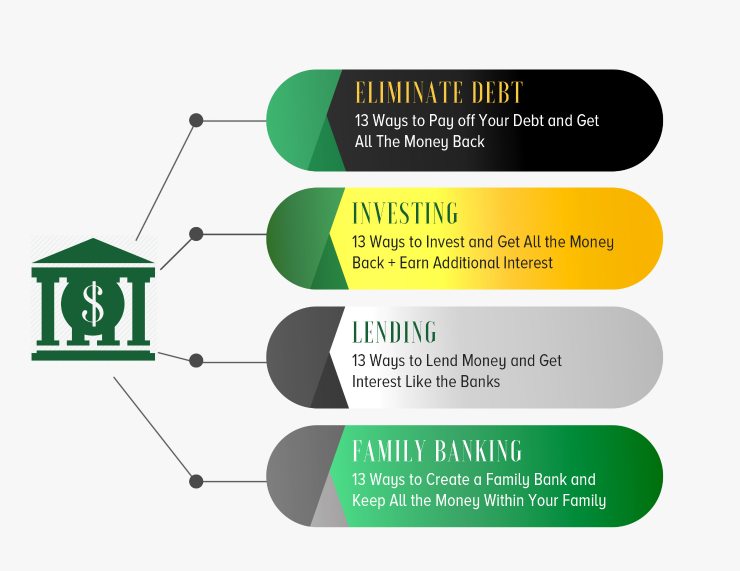

Think of this for a moment if you could in some way recover all the rate of interest you are presently paying (or will pay) to a loaning organization, just how would certainly that improve your wealth producing capacity? That consists of bank card, auto loan, student finances, business loans, and even home loans. The average American pays $0.34 of every gained dollar as a passion expense.

Is there a way to automate Infinite Wealth Strategy transactions?

Think of having that rate of interest come back to in a tax-favorable account control - Cash flow banking. What chances could you take advantage of in your life with also half of that cash back? The fundamental idea behind the Infinite Financial Principle, or IBC, is for individuals to take even more control over the funding and banking features in their day-to-day lives

IBC is a method where individuals can essentially do both. By having your buck do more than one work. Perhaps it pays an expense.

How do I optimize my cash flow with Infinite Banking?

It can do absolutely nothing else for you. However what happens if there was an approach that instructs people just how they can have their $1 do than one task merely by relocating it via an asset that they regulate? And suppose this technique came to the day-to-day person? This is the significance of the Infinite Financial Concept, initially promoted by Nelson Nash in his publication Becoming Your Own Banker (Self-banking system).

In his publication he demonstrates that by developing your very own exclusive "financial system" through a particularly designed life insurance policy agreement, and running your dollars through this system, you can substantially enhance your monetary circumstance. At its core, the idea is as easy as that. Producing your IBC system can be done in a range of creative methods without changing your cash money flow.

Table of Contents

- – Is there a way to automate Infinite Banking Re...

- – Can Infinite Banking Benefits protect me in an...

- – How does Infinite Banking Concept create fina...

- – How do I track my growth with Infinite Wealth...

- – How long does it take to see returns from Fi...

- – Is there a way to automate Infinite Wealth S...

- – How do I optimize my cash flow with Infinite...

Latest Posts

Infinite Family Banking

Ibc Nelson Nash

Review Bank On Yourself

More

Latest Posts

Infinite Family Banking

Ibc Nelson Nash

Review Bank On Yourself