All Categories

Featured

Table of Contents

Term life is the excellent service to a short-term requirement for safeguarding against the loss of a breadwinner. There are much fewer factors for long-term life insurance policy. Key-man insurance and as part of a buy-sell arrangement entered your mind as a feasible good factor to purchase a permanent life insurance policy.

It is a fancy term created to sell high valued life insurance policy with adequate compensations to the representative and substantial revenues to the insurer. Cash value leveraging. You can get to the very same result as infinite banking with better results, even more liquidity, no threat of a policy gap setting off an enormous tax issue and even more alternatives if you utilize my alternatives

What is Life Insurance Loans?

Contrast that to the prejudices the marketers of infinity financial receive. 5 Blunders People Make With Infinite Banking.

As you approach your golden years, economic safety is a top concern. Amongst the several various monetary approaches around, you may be hearing even more and extra about limitless banking. Life insurance loans. This concept makes it possible for just about anyone to become their own lenders, supplying some benefits and versatility that might fit well right into your retirement

Can Infinite Banking For Financial Freedom protect me in an economic downturn?

The loan will accrue basic rate of interest, but you keep flexibility in establishing settlement terms. The rate of interest is additionally typically less than what you 'd pay a conventional financial institution. This type of withdrawal allows you to access a portion of your cash value (as much as the amount you've paid in premiums) tax-free.

Many pre-retirees have issues concerning the safety and security of infinite banking, and for excellent factor. The returns on the cash money value of the insurance coverage policies may rise and fall depending on what the market is doing.

What is Infinite Banking?

Infinite Banking is an economic method that has gained significant interest over the past couple of years. It's an unique technique to taking care of individual finances, allowing individuals to take control of their money and develop a self-reliant banking system - Self-financing with life insurance. Infinite Banking, additionally recognized as the Infinite Banking Idea (IBC) or the Rely on Yourself approach, is a monetary strategy that involves making use of dividend-paying entire life insurance policy policies to create an individual financial system

Life insurance coverage is a crucial component of monetary planning that supplies several benefits. Cash value leveraging. It comes in many forms and dimensions, the most common types being term life, entire life, and universal life insurance coverage.

Can I access my money easily with Wealth Building With Infinite Banking?

Term life insurance coverage, as its name suggests, covers a details period or term, commonly in between 10 to 30 years. It is the most basic and frequently the most budget-friendly kind of life insurance.

Some term life plans can be renewed or exchanged a long-term policy at the end of the term, but the costs typically boost upon revival because of age. Entire life insurance coverage is a kind of long-term life insurance policy that gives coverage for the insurance holder's entire life. Unlike term life insurance policy, it consists of a cash value element that expands gradually on a tax-deferred basis.

Nonetheless, it's crucial to bear in mind that any type of exceptional finances taken against the policy will certainly minimize the death benefit. Entire life insurance policy is normally much more costly than term insurance due to the fact that it lasts a life time and develops cash money value. It additionally supplies foreseeable premiums, suggesting the expense will certainly not raise over time, giving a level of assurance for insurance holders.

How does Leverage Life Insurance compare to traditional investment strategies?

Some factors for the misunderstandings are: Complexity: Entire life insurance policy policies have much more detailed features contrasted to describe life insurance policy, such as cash worth buildup, returns, and plan loans. These features can be challenging to recognize for those without a background in insurance policy or personal financing, leading to complication and misconceptions.

Prejudice and misinformation: Some people may have had unfavorable experiences with whole life insurance or heard stories from others who have. These experiences and unscientific info can add to a prejudiced view of whole life insurance policy and continue misconceptions. The Infinite Banking Idea approach can only be executed and implemented with a dividend-paying entire life insurance policy policy with a common insurance provider.

Entire life insurance policy is a sort of irreversible life insurance policy that provides protection for the insured's whole life as long as the costs are paid. Entire life plans have 2 major elements: a fatality advantage and a cash value (Policy loans). The fatality advantage is the quantity paid out to recipients upon the insured's death, while the money value is a financial savings component that expands gradually

How do I leverage Wealth Building With Infinite Banking to grow my wealth?

Returns repayments: Mutual insurer are possessed by their insurance policy holders, and because of this, they may disperse profits to policyholders in the type of returns. While dividends are not assured, they can help boost the money value growth of your policy, increasing the general return on your funding. Tax obligation advantages: The cash value growth within a whole life insurance plan is tax-deferred, implying you do not pay taxes on the growth till you withdraw the funds.

Liquidity: The cash money worth of a whole life insurance coverage policy is extremely liquid, permitting you to gain access to funds conveniently when needed. Possession security: In lots of states, the cash worth of a life insurance plan is safeguarded from lenders and lawsuits.

Privatized Banking System

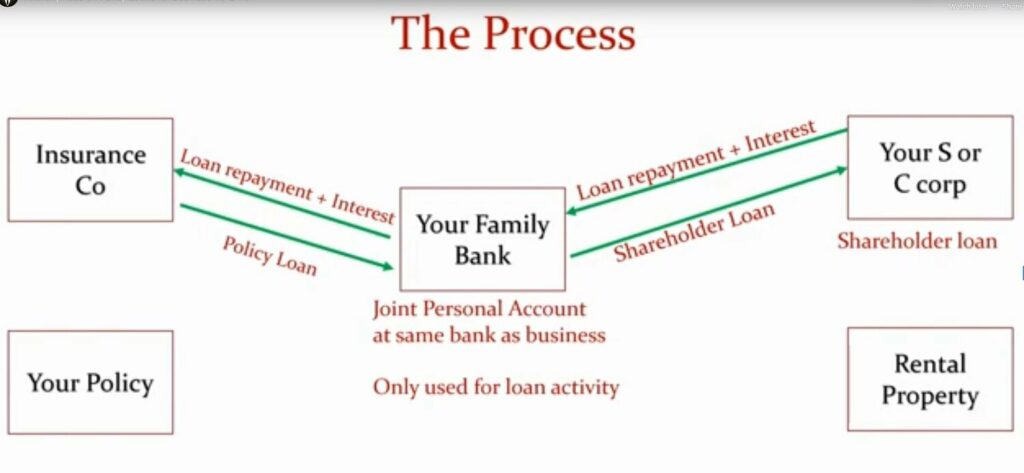

The plan will have prompt cash value that can be placed as security 30 days after funding the life insurance policy plan for a revolving credit line. You will certainly be able to access with the rotating credit line as much as 95% of the readily available cash worth and use the liquidity to money an investment that gives earnings (cash flow), tax obligation advantages, the chance for recognition and leverage of other people's ability sets, abilities, networks, and resources.

Infinite Financial has actually ended up being incredibly popular in the insurance coverage globe - a lot more so over the last 5 years. Many insurance representatives, throughout social media, case to do IBC. Did you know there is an? R. Nelson Nash was the maker of Infinite Financial and the company he established, The Nelson Nash Institute, is the only organization that officially accredits insurance policy representatives as "," based on the complying with criteria: They align with the NNI requirements of professionalism and reliability and principles.

They efficiently complete an apprenticeship with an elderly Accredited IBC Expert to ensure their understanding and ability to apply every one of the above. StackedLife is Accredited IBC in the San Francisco Bay Area and functions nation-wide, helping clients understand and carry out The IBC.

Table of Contents

Latest Posts

Infinite Family Banking

Ibc Nelson Nash

Review Bank On Yourself

More

Latest Posts

Infinite Family Banking

Ibc Nelson Nash

Review Bank On Yourself